Switzerland, an attractive business hub for research and innovation

Is innovation the heart of your business?

- Your intellectual property is located in Switzerland, or you plan to transfer your intellectual property to Switzerland.

- You want to take advantage of the Patent Box and the additional R&D tax deductions as well as be compliant with the OECD Transfer Pricing (TP) standards.

Why choose Switzerland for your next destination?

Switzerland is an attractive innovation place for talents, capital and for tax purposes.

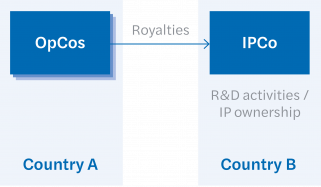

Your current structure outside Switzerland

You own an intellectual property holding company ("IPCo") in country B which holds and manages the group IP portfolio and licenses the IP rights to affiliated operating companies ("OPCos") located in country A for their use.

Said structure may generate issues regarding transfer pricing and withholding tax on royalty payments made by OpCo to IPCo.

Are you considering relocating your IP to another country?

To avoid issues related to the transfer of the IPCo, it will be essential to define the strategy of the group for IP operating:

- Evaluate the transferred Intellectual Property

- Analyse the benefits of the treaty network

- Design a tax optimal transfer of IP

- Enhance activities and substance

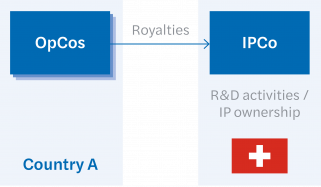

Why relocate your IPCo to Switzerland?

Your potential future structure in Switzerland

What Switzerland can offer?

- Step-up migration

- International patent protection

- Low-income tax burden on intellectual property royalties and license fee income thanks to a compatible OECD patent box regime

- Competitive combined effective income tax rate. From 2024, introduction of the global minimum taxation of 15% for large international groups as per GloBE rules

- Large tax treaty network

- No withholding tax levied on royalty payments as per domestic law

- Tax credit available on foreign tax at source

- Tax efficient dividend repatriation to ultimate corporate shareholder

- Easy and direct relationship with the Swiss competent tax authorities

- Minimal requirements regarding transfer pricing documentation

- No CFC rules

Why Mazars is the right partner to assist you?

Mazars offers you a large range of audit and advisory services. We serve our national and international clients in all sectors throughout Switzerland, in particular:

- Advising on setting up a Swiss entity: Support for the group on various issues relating to the foreign nature of shareholders (support in coordinating the efforts of the various players involved in setting up a structure: notary, bank, commercial register) or concerning the drafting of certain clauses of the Articles of Association to optimise potential future transactions involving the company's capital, or to make the company's operations more efficient

- Advising on the structuring of the group to optimize the cashflow, the diversification and the future growth of the group

- Advising on financial valuation of assets / enterprises, Merger & Acquisition, group financing

- Day-to-day support, or regular monitoring and implementation of monitoring schedules to ensure compliance of the company's development in Switzerland and globally with international transparency and sustainability requirements

- Support in setting up internal audit procedures and compliance tools to assist the management in its development strategy in Switzerland and worldwide

- Support the board members in the identification and management of business risks and opportunities thanks to tailor-made procedure and IT tools