ORSA Survey 2018

ORSA was introduced as a key element of the Solvency II Directive, which sets out Europe-wide harmonised solvency rules. As part of their ORSA, regulated insurance companies should implement appropriate processes in order to be able to capture, limit and monitor what they deem to be material risks.

A survey of 36 insurers in Switzerland conducted by Mazars and the ZHAW School of Management and Law paints a positive picture of own risk and solvency assessment (ORSA) implementation. The second instance of this study to have ever been carried out examines the following aspects:

- Status of implementation and current challenges,

- Planning horizon, scenarios used and perspectives,

- Reporting and timing of submission of reports,

- Organisational embedding, benefits and wishes regarding supervision.

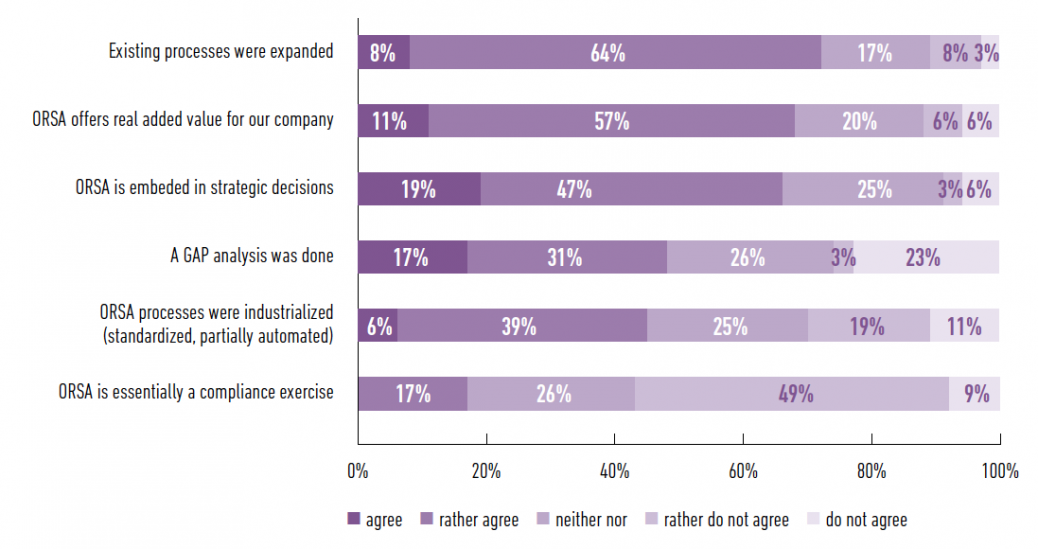

Illustration 1: How do you assess the level of implementation of ORSA within your company? (N=36)

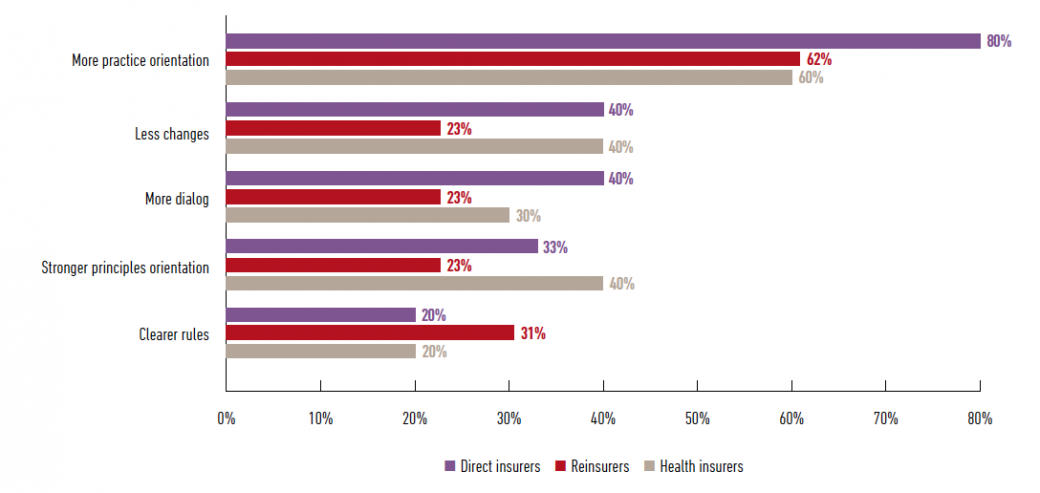

Illustration 2: What do you want / expect from politics and / or supervision? (N=34)